This year’s Index of Dependence on Government presented startling findings about the sharp increase of Americans who rely on the federal government for housing, food, income, student aid or other assistance.

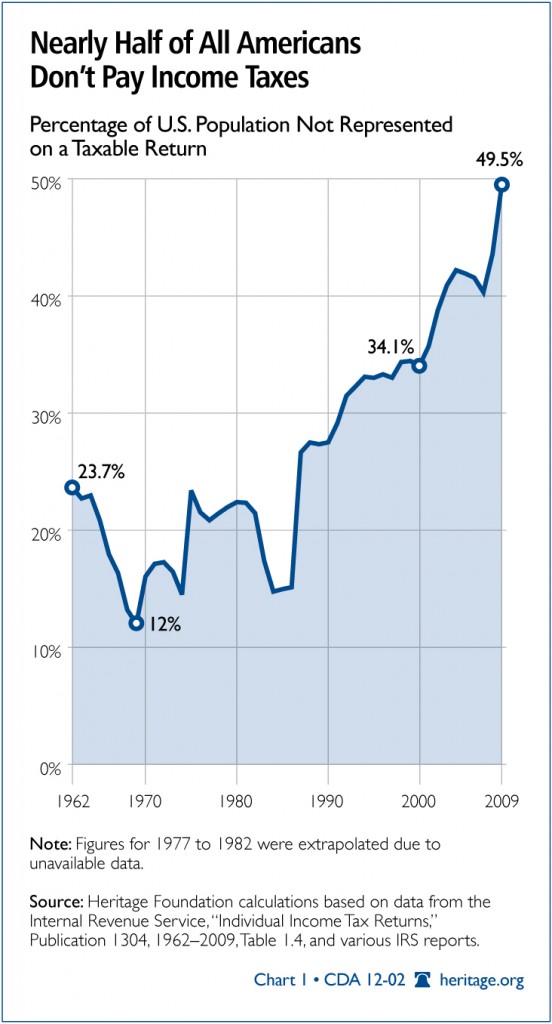

Another eye-popping number was the percentage of Americans who don’t pay income taxes, which now accounts for nearly half of the U.S. population. Meanwhile, most of that population receives generous federal benefits.

“One of the most worrying trends in the Index is the coinciding growth in the non-taxpaying public,” wrote Heritage authors Bill Beach and Patrick Tyrrell. “The percentage of people who do not pay federal income taxes, and who are not claimed as dependents by someone who does pay them, jumped from 14.8 percent in 1984 to 49.5 percent in 2009.”

That means 151.7 million Americans paid nothing in 2009. By comparison, 34.8 million tax filers paid no taxes in 1984.

The rapid growth of Americans who don’t pay income taxes is particularly alarming for the fate of the American form of government, Beach and Tyrrell warned. Coupled with higher spending on government programs, it is already proving to be a major fiscal challenge.

“This trend should concern everyone who supports America’s republican form of government,” Beach and Tyrrell wrote. “If the citizens’ representatives are elected by an increasing percentage of voters who pay no income tax, how long will it be before these representatives respond more to demands for yet more entitlements and subsidies from non-payers than to the pleas of taxpayers to exercise greater spending prudence?”

http://blog.heritage.org/2012/02/19/cha ... ome-taxes/

No representation without taxation

No representation without taxation

or something...

“If you trust in yourself, and believe in your dreams, and follow your star. . . you'll still get beaten by people who spent their time working hard and learning things and weren't so lazy.”

Re: No representation without taxation

Rather a distortion of reality. "Income taxes" does not include "Payroll Taxes," which, in effect, take about 14% of most workers' earnings. Less now, with the temporary (and foolish) reduction in the employees' portion of the payroll tax.

At the bottom of the economic totem pole, most working Americans pay more in payroll taxes than they do in income taxes, but many don't understand that they are also paying their "employer's contribution," with their earnings.

At the bottom of the economic totem pole, most working Americans pay more in payroll taxes than they do in income taxes, but many don't understand that they are also paying their "employer's contribution," with their earnings.

Re: No representation without taxation

On the other hand, they are supposedly earning a benefit entitlement with the payment of Social Security and unemployment. Gob, you are sounding like Republican posting this sort of thing.

Re: No representation without taxation

I just found it fascinating that a country could have those figures. (Though I'm happy to admit that I'll take guidance from my American chums on the true import of them.)

“If you trust in yourself, and believe in your dreams, and follow your star. . . you'll still get beaten by people who spent their time working hard and learning things and weren't so lazy.”

Re: No representation without taxation

I have plenty of liberal friends who also think every wage earner should pay federal income tax at least at a minimal level so that everyone has "buy-in".

Re: No representation without taxation

When you increase the number in, or close to, poverty the number who pay income taxes goes down.

Not surprising.

Bush II fucked more people in the ass than in any 8 year period since the great depression.

Federal benefits are anything but "generous" what jackass wrote that? Oh wait, this is the Heritage Foundation. No connection to reality then.

yrs,

rubato

Not surprising.

Bush II fucked more people in the ass than in any 8 year period since the great depression.

Meanwhile, most of that population receives generous federal benefits.

Federal benefits are anything but "generous" what jackass wrote that? Oh wait, this is the Heritage Foundation. No connection to reality then.

Well screw me pink what happened to the "rich people's lobby" who have fucked these exact same people into poverty for 30 years? Have they sold off all the media they have controlled for 30 years? Isn't brother Rush still whipping up hatred for women, gays, and "libruls" so you can manipulate them?"

“This trend should concern everyone who supports America’s republican form of government,” Beach and Tyrrell wrote. “If the citizens’ representatives are elected by an increasing percentage of voters who pay no income tax, how long will it be before these representatives respond more to demands for yet more entitlements and subsidies from non-payers than to the pleas of taxpayers to exercise greater spending prudence?”

yrs,

rubato

Re: No representation without taxation

Everyone, in fact, does pay taxes both federal and state. Those at the bottom end of the scale pay very high taxes and have no lobbies on their behalf.Long Run wrote:I have plenty of liberal friends who also think every wage earner should pay federal income tax at least at a minimal level so that everyone has "buy-in".

yrs,

rubato

Re: No representation without taxation

Since the myth of the "social security trust fund" has been fully and emphatically debunked, there is no longer any reason to have the so-called "payroll taxes" separate from federal income taxes, and the two should be consolidated.

Re: No representation without taxation

“If you trust in yourself, and believe in your dreams, and follow your star. . . you'll still get beaten by people who spent their time working hard and learning things and weren't so lazy.”