France's highest court has approved a 75% tax on high earners that is one of President Francois Hollande's signature policies.

The initial proposal to tax individual incomes was ruled unconstitutional by the Constitutional Council almost exactly one year ago.

But the government modified it to make employers liable for the 75% tax on salaries exceeding 1m euros (£830,000).

The levy will last two years, affecting income earned this year and in 2014.

Football clubs in France went on strike earlier this year over the issue, saying many of France's clubs are financially fragile and say the plans could spark an exodus of top players who are paid huge salaries.

The Qatari-owned Paris Saint-Germain has more than 10 players whose pay exceeds 1m euros, including the Swedish striker Zlatan Ibrahimovic.

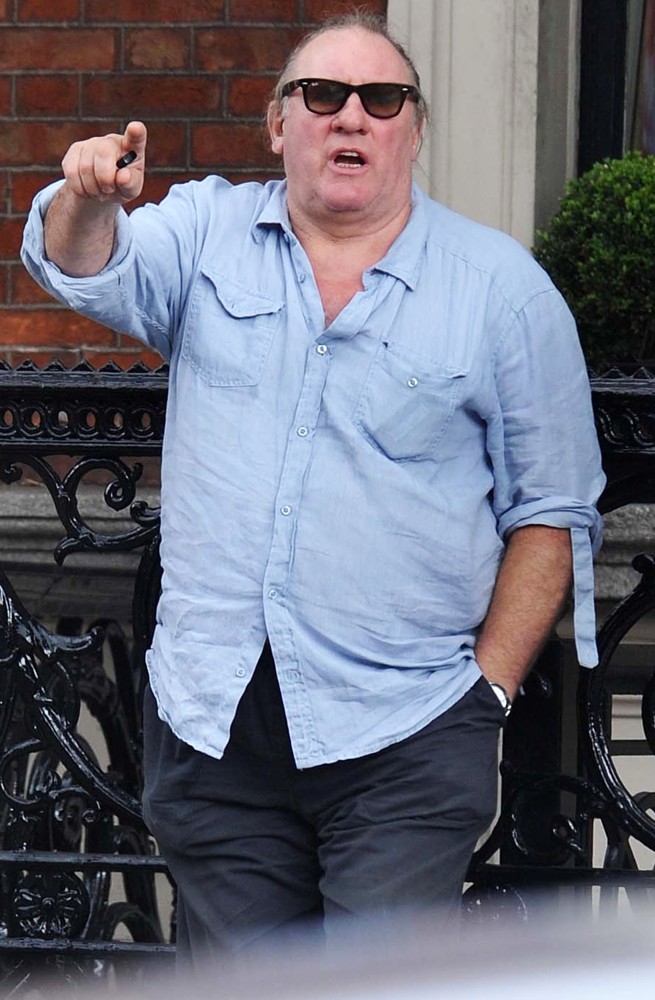

There has also been a chorus of protest from businesses and wealthy individuals who have condemned the tax - including film star Gerard Depardieu, who left the country in protest.

Polls suggest a large majority in France back the temporary tax.

Unlike many other countries in Europe, France aims to bring down its huge public deficit by raising taxes as well as some spending cuts.

The highest tax rate in the UK is 45% and is applied to individuals.

75% tax

75% tax

“If you trust in yourself, and believe in your dreams, and follow your star. . . you'll still get beaten by people who spent their time working hard and learning things and weren't so lazy.”

Re: 75% tax

If that tax rate is an effective tax rate, (ie, people really have to pay it) then it is not only incredibly stupid from an economic stand point in a global economy (since it will do nothing but encourage capital flight) but in my view it's downright immoral...

(Yes, there was a time, in the 1950's before the Kennedy tax cut, where we had tax rates in this country that technically reached as high as 90%, but the code contained so many loopholes that no one actually paid those rates...And that was also at a time when the US economy was the 800 pound gorilla in the room, moving money was more complicated, and there weren't that many attractive alternatives...)

I really wouldn't have a problem with raising rates somewhat higher in this country from where they are now on incomes in the tens of millions, or hundreds of millions, or billion dollar ranges, but any income tax rate above 49%, no matter how high one's income is, amounts to pure theft in my opinion.

There is absolutely no excuse for the government to be able to take more of one's income than one is allowed to keep themselves; as I said, that is just simply immoral.

(Yes, there was a time, in the 1950's before the Kennedy tax cut, where we had tax rates in this country that technically reached as high as 90%, but the code contained so many loopholes that no one actually paid those rates...And that was also at a time when the US economy was the 800 pound gorilla in the room, moving money was more complicated, and there weren't that many attractive alternatives...)

I really wouldn't have a problem with raising rates somewhat higher in this country from where they are now on incomes in the tens of millions, or hundreds of millions, or billion dollar ranges, but any income tax rate above 49%, no matter how high one's income is, amounts to pure theft in my opinion.

There is absolutely no excuse for the government to be able to take more of one's income than one is allowed to keep themselves; as I said, that is just simply immoral.

Re: 75% tax

Because I am so filthy rich I would gladly give 75% of my income to help those who are in need because it would not change my lifestyle in the least. Anyone that would not do the same is very likely a hateful democrat-stalking republican moron with the initials LJ.

yrs,

joegato

yrs,

joegato

Re: 75% tax

Girard Depardieu could stand to miss a few meals a week. He has become quite the whale.

Cutting his cheese allowance would be good for him.

Yrs,

Rubato

Cutting his cheese allowance would be good for him.

Yrs,

Rubato

- MajGenl.Meade

- Posts: 21522

- Joined: Sun Apr 25, 2010 8:51 am

- Location: Groot Brakrivier

- Contact:

Re: 75% tax

Oh surely not? I don't think Depardieu cutting his cheese would be at all helpful

For Christianity, by identifying truth with faith, must teach-and, properly understood, does teach-that any interference with the truth is immoral. A Christian with faith has nothing to fear from the facts

Re: 75% tax

whoooeeee that boy has been spending way too much time at the Fromagerie and not enough at Le Gym! Some caring soul should kidnap him and air-drop him into "The Biggest Loser" French edition. [Le Plus Grand Perdant!]

I can't see a marginal rate of 75% on income over $1M causing him anything but physical improvement

yrs,

rubato

Re: 75% tax

Gob wrote:"...

Football clubs in France went on strike earlier this year over the issue, saying many of France's clubs are financially fragile and say the plans could spark an exodus of top players who are paid huge salaries.

The Qatari-owned Paris Saint-Germain has more than 10 players whose pay exceeds 1m euros, including the Swedish striker Zlatan Ibrahimovic.

... "

So these nimrods have never heard of deferred compensation? It is an ideal solution for people who have inherently limited years of high-earning like professional athletes.

yrs,

rubato

-

oldr_n_wsr

- Posts: 10838

- Joined: Sun Apr 18, 2010 1:59 am

Re: 75% tax

Sounds like a loophole. Get your money after the tax expires (if it ever really expiresdeferred compensation

Once again, tax the crap out of people and they will find a way not to pay it.

- MajGenl.Meade

- Posts: 21522

- Joined: Sun Apr 25, 2010 8:51 am

- Location: Groot Brakrivier

- Contact:

Re: 75% tax

I believe the nimrods have observed how "deferred compensation" works in the USA and wouldn't mind some of that action. But it is not an option for a European footballer, as I understand the case.

The clubs control the process and they have no desire at all to change a system that (the players say) benefits them to the detriment of the players. A footballer signs a contract and his compensation is payable over the period of the contract. Full stop. Contracts cannot be traded - in essence, club B simultaneously negotiates a new contract for a player and negotiates with his current club A the amount of compensation they will receive for the loss of his services part-way through a contract. The player is transferred - not the contract.

European clubs have no wish to be left holding the bag for millions of pounds to pay out to some superannuated non-player. There are no Manny Ramirez or A-Rod horror stories looming on the financial horizon for Euro soccer.

This French tax-plan is insanity - it might result in hordes of hairy Gallic footballers sneaking under the Channel and turning up to play for Stoke City

The clubs control the process and they have no desire at all to change a system that (the players say) benefits them to the detriment of the players. A footballer signs a contract and his compensation is payable over the period of the contract. Full stop. Contracts cannot be traded - in essence, club B simultaneously negotiates a new contract for a player and negotiates with his current club A the amount of compensation they will receive for the loss of his services part-way through a contract. The player is transferred - not the contract.

European clubs have no wish to be left holding the bag for millions of pounds to pay out to some superannuated non-player. There are no Manny Ramirez or A-Rod horror stories looming on the financial horizon for Euro soccer.

This French tax-plan is insanity - it might result in hordes of hairy Gallic footballers sneaking under the Channel and turning up to play for Stoke City

For Christianity, by identifying truth with faith, must teach-and, properly understood, does teach-that any interference with the truth is immoral. A Christian with faith has nothing to fear from the facts

Re: 75% tax

It seems to me that by limiting this (supposedly) to two years, that Hollande realizes the risk he's running for capital flight and loss of talent, and is crossing his fingers hoping that high income earners will just suck it up, and that the government will be able to realize a short term revenue boost with little downside. (While scoring points with his class envy oriented political base.)

If that gamble proves to be incorrect, this confiscatory tax rate could have a deeply damaging impact on the French economy. It will be interesting to see how this turns out.

If that gamble proves to be incorrect, this confiscatory tax rate could have a deeply damaging impact on the French economy. It will be interesting to see how this turns out.

Re: 75% tax

We should thank the French for providing this experiment. If it does not hurt their wine and cheese production, the worst that can happen to us is that a few of the wealthy French diaspora will end up in our towns.

Re: 75% tax

One popular method of using deferred compensation is for the employer to pay the whole salary but a part is paid to a second party who arranges the defferral; they recieve the whole whack that year and then pay out in installments to the employee as-arranged.MajGenl.Meade wrote:"... A footballer signs a contract and his compensation is payable over the period of the contract. Full stop. ... "

There are so many methods available for someone who makes a lot of money to avoid or defer taxes that the whole thing is really a joke. A joke on you.

My wife can defer up to 100% of her salary and bonus, invest the deferral and make use of the principal and profits later on. Withdrawal, and thus taxation, are voluntary events and can be timed to maximize the economic convenience. If the tax system changes, and it does not matter in which direction, the ability to choose in what year money is taxed gives an unsurmountable advantage to those who can choose. If the rate goes up you withdraw more before it does, if it goes down you wait. Simple.

yrs,

rubato

Re: 75% tax

The only places in the US with restaurants comparable to France are New York, San Francisco, Los Angeles, Chicago, and New Orleans.Long Run wrote:We should thank the French for providing this experiment. If it does not hurt their wine and cheese production, the worst that can happen to us is that a few of the wealthy French diaspora will end up in our towns.

French Wines have been bid up to stratospheric prices by Chinese buyers who are also buying the wineries.

yrs,

rubato

Re: 75% tax

Gee whiz, guess the missus ain't on board with that whole "I want to pay more taxes" refrain you like to sing around here rube...My wife can defer up to 100% of her salary and bonus, invest the deferral and make use of the principal and profits later on. Withdrawal, and thus taxation, are voluntary events and can be timed to maximize the economic convenience. If the tax system changes, and it does not matter in which direction, the ability to choose in what year money is taxed gives an unsurmountable advantage to those who can choose. If the rate goes up you withdraw more before it does, if it goes down you wait. Simple.

What a shockaroo....

Re: 75% tax

In Keith Richards' autobiography he mentioned that the Rolling Stones moved to France at one time to escape Britain's 90% income tax.

Back then time was on their side...

Back then time was on their side...

Re: 75% tax

Is the French tax marginal?

Reason is valuable only when it performs against the wordless physical background of the universe.

- MajGenl.Meade

- Posts: 21522

- Joined: Sun Apr 25, 2010 8:51 am

- Location: Groot Brakrivier

- Contact:

Re: 75% tax

Indeed it is simple - and simply not an available option for European football players AFAIK for reasons stated (club ownerships do not want to do it). I hadn't realised your wife played soccer in Europe though...rubato wrote: One popular method of using deferred compensation is for the employer to pay the whole salary but a part is paid to a second party who arranges the defferral; they recieve the whole whack that year and then pay out in installments to the employee as-arranged..... My wife can defer up to 100% of her salary and bonus, invest the deferral and make use of the principal and profits later on. Withdrawal, and thus taxation, are voluntary events and can be timed to maximize the economic convenience. If the tax system changes, and it does not matter in which direction, the ability to choose in what year money is taxed gives an unsurmountable advantage to those who can choose. If the rate goes up you withdraw more before it does, if it goes down you wait. Simple.

yrs,

rubato

For Christianity, by identifying truth with faith, must teach-and, properly understood, does teach-that any interference with the truth is immoral. A Christian with faith has nothing to fear from the facts

Re: 75% tax

What do you think?Andrew D wrote:Is the French tax marginal?

yrs,

rubato