http://www.bbc.com/news/world-europe-33307263Greece imposes capital controls as crisis deepens

Greece moved to check the growing strains on its crippled financial system on Sunday, closing its banks and imposing capital controls that brought the prospect of being forced out of the euro into plain sight.

After bailout talks between the leftwing government and foreign lenders broke down at the weekend, the European Central Bank froze vital funding support to Greece's banks, leaving Athens with little choice but to shut down the system to keep the banks from collapsing.

Banks are expected to be closed all next week, and there will be a daily 60 euro limit on cash withdrawals from cash machines, which will reopen on Tuesday. Capital controls are likely to last for many months at least.

"The more calmly we deal with difficulties, the sooner we can overcome them and the milder their consequences will be," a somber-looking Prime Minister Alexis Tsipras said in a televised address. He promised bank deposits would be safe [I wonder who's stupid enough to believe that?]and salaries paid.

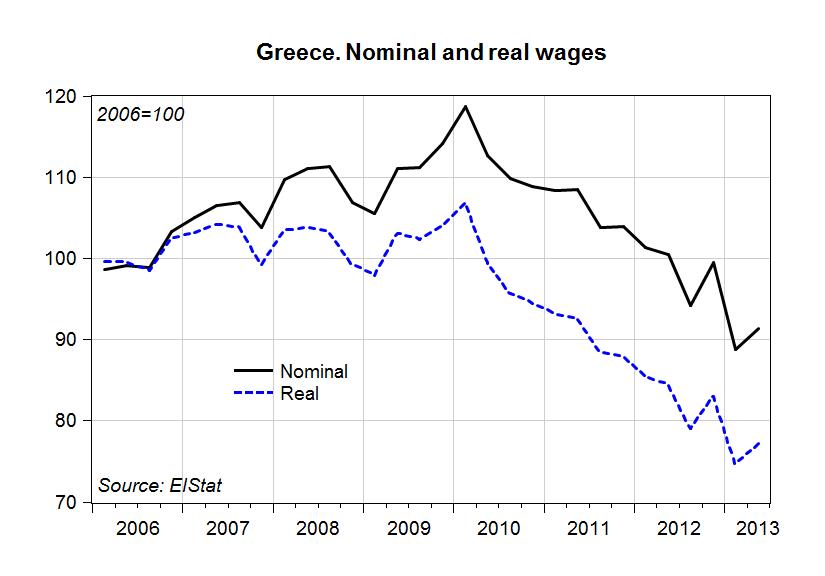

Even as Tsipras spoke, the lines forming at petrol stations and in front of the shrinking number of bank machines that still contained cash highlighted the scale of the disaster facing Greeks, who have endured more than six years of economic decline.

The failure to reach a deal with creditors leaves Greece set to default on 1.6 billion euros of loans from the International Monetary Fund that fall due on Tuesday. Athens must repay billions of euros to the European Central Bank in the coming months.

The impending default on the IMF loans leaves Greece sliding toward a euro exit with unforeseeable consequences for Europe's grand project to bind its nations into an unbreakable union by means of a common currency. It also carries broad implications for the global financial system.

After months of wrangling, Greece's exasperated European partners have put the blame for the crisis squarely on Tsipras' shoulders.The creditors wanted Greece to cut pensions and raise taxes in ways that Tsipras has long argued would deepen one of the worst economic crises of modern times in a country where a quarter of the workforce is already unemployed.The 40-year-old premier caught them by surprise in the early hours of Saturday by rejecting the demands of lenders and calling a bailout referendum.

After announcing the referendum, Tsipras asked for an extension of Greece's existing bailout until after the July 5th vote. Euro zone officials refused, and in his televised address Tsipras bemoaned the refusal as an "unprecedented act".[This guy wants to hold a referendum asking people if they want to pay their debts, and he's offended that the countries they owe the money to wont keep lending him money while he does it? Geez, what a moron...]

Despite the hardening of positions, officials around Europe and the United States made a frantic round of calls and organized meetings to try to salvage the situation.

U.S. President Barack Obama called German Chancellor Angela Merkel, and senior U.S. officials urged Europe and the IMF to come up with a plan to hold the single currency together and keep Greece in the euro zone. The German and French governments announced emergency political meetings.

The Greeks have capped off decades of reckless spending and borrowing combined with a culture of tax avoidance (among both the upper and middle class; an estimated 40% of those eligible to pay income taxes don't.) by electing a complete idiot as Prime Minister because he told them what they wanted to hear. These folks would apparently rather do almost anything then face reality.

Seems to me that refusing to continue to float more money while they hold this moronic referendum is exactly the right thing to do. (I think we'll have a family meeting today and vote on whether or not we want to pay our debts; I'm expecting the vote will probably be no.) Let the Greeks get a little taste of life without financial bailout support.

The Greeks have basically two choices. They can finally be realistic and make the hard and painful but necessary decisions to get their economic house in order....

Or they can default, withdraw from the Euro, and let hyper-inflation do it for them.