The 10 worst states for taxes in 2014

For upper middle income earners, high net-worth individuals, retirees, and certainly the “one percent” – where you live can make a huge difference in how much of your money you get to keep at the end of the year and how much you need to fork over to your state.

To help individuals and businesses make an informed choice, the Tax Foundation collects data on more than 100 tax provisions for each state and then ranks them to create its annual State Business Tax Climate Index. The 10 worst states on the list all levy complex, non-neutral taxes that favor some economic activities over others and have comparatively high individual and corporate tax rates.

The data are mixed as to whether a tough tax climate actually does push people and businesses to live in low-tax states. A report released last year by the Institute on Taxation and Economic Policy found that residents of states with high income tax were actually experiencing economic conditions that were as good as or better than those living in states without a personal income tax.

Plus, sometimes people are inclined to pay higher taxes to live in a certain location. New York, California and Maryland, for example, are all among the states that ranked worst for taxes, but they’re also hives of business activity, high salaries and employment. Meanwhile, families with children have historically been willing to pay higher property taxes in exchange for higher quality schools and other services.

New York

Top State Income Tax Rate: 8.82 percent

Sales tax: 4 percent county sales tax raises that to 8.625%

Property taxes per capita: $2,280 My property taxes are in the $7k neighborhood for 2014

The Empire State takes the prize as the worst state for taxes, thanks to its high individual tax rate and relatively high sales tax. New York is in a virtual tie with neighboring New Jersey, though the former state gets the bottom spot because its individual income tax suffers from such high rates and narrow bases, according to the Tax Foundation. New York Governor Andrew Cuomo has announced the formation of a tax relief commission to look for ways to transform the state’s onerous tax code.

New Jersey

Top State Income Tax Rate: 8.97 percent

Sales tax: 7 percent

Property taxes per capita: $2,819

The Garden State scores poorly in almost every tax category, and it’s almost tied with New York for the dubious honor of being the worst state in the country for taxes. New Jersey’s per capita property tax is the most onerous in the country. The state has also scaled back a property tax relief program that provided rebates to homeowners struggling to pay taxes on their homestead.

California

Top State Income Tax Rate: 13.3 percent

Sales tax: 7.5 percent

Property tax per capita: $1,450

California has one of the highest income taxes in the country and imposes an alternative minimum tax on both individuals and corporations. The Golden State relies heavily on the income tax revenue generated by its richest residents. This year such revenues are expected to comprise two thirds of California’s general-fund reserves. Its 7.5 percent sales tax rate includes a mandatory statewide local tax of 1 percent.

Minnesota

Top State Income Tax Rate: 7.85 percent

Sales tax: 6.875 percent

Property tax per capita: $1,412

Minnesota dropped several places in the rankings this year, following changes to its tax code, including a retroactive individual income tax hike on earners making more than $150,000. The state’s top income tax rate leapt from 7.85 percent to 9.85 percent. The state also has a relatively high corporate income tax rate.

Rhode Island

Top State Income Tax Rate: 5.99 percent

Sales tax: 7 percent

Property tax per capita: $2,083

The Ocean State lands close to the bottom of the list because it ranks poorly on corporate taxes and property taxes. Rhode Island was named least tax-friendly state in the country for retirees by Kiplinger Magazine, thanks to its practice of taxing Social Security benefits, pension income, and almost all other sources of retirement income.

Vermont

Top State Income Tax Rate: 8.95 percent

Sales tax: 6 percent

Property tax per capita: $2,166

Vermont’s property taxes are the third worst in the country, with an effective property tax rate of 5.27 percent. The state is also on the bottom of the list thanks to a relatively high individual income tax rate, sales tax and corporate taxes.

North Carolina

Top State Income Tax Rate: 7.75 percent

Sales tax: 4.75 percent

Property tax per capita: $902

While the state ranks near the bottom right now, its position will likely change going forward. Starting this year, North Carolina will change its income tax policy from a graduated bracket system with a top rate of 7.75 percent, to a simpler structure with a flat rate of 5.8 percent in 2014 and 5.75 percent in 2015. That and other changes to corporate and estate tax policy will likely move the Tar Heel State into the top half of the rankings in 2015.

Wisconsin

Top State Income Tax Rate: 7.75 percent

Sales tax rate: 5 percent

Property tax per capita: $1,698

Wisconsin ranks poorly due, in part, to its relatively high income tax, which includes an AMT for individuals. However, since the ranking, the state has passed some reforms to make its tax code more favorable, including cutting the top individual income tax rate from 7.75 percent to 7.65 percent and eliminating one of its five income brackets. Governor Scott Walker has recently floated the idea of getting rid of the state’s income tax entirely.

Connecticut

Top State Income tax Rate: 6.7 percent

Sales tax rate: 6.35 percent

Property tax per capita: $2,522

The Constitution State’s property taxes are the second worst in the country, after New Jersey. The state also has relatively high sales and income tax rates. Its “Tax Freedom Day,” the day until taxpayers must work to have earned enough money to pay off their total tax bill, is May 13th, the second latest nationally.

Maryland

Top state income tax rate: 5.75 percent

Sales tax rate: 6 percent

Per capita property tax: $1,467

Maryland makes the 10th worst spot on the list because of its relatively high taxes across the board. The state is currently considering a proposal that would lower its corporate income tax rate in the next five years from its current 8.25 percent to 6 percent, which would put it in line with neighboring Virginia. It’s also looking into increasing the estate tax threshold from $1 million to $5.25 million.

We're (NY) Number 1

-

oldr_n_wsr

- Posts: 10838

- Joined: Sun Apr 18, 2010 1:59 am

We're (NY) Number 1

No wonder the son moved to Texas.

Re: We're (NY) Number 1

I note that "Taxachusetts" is no where on that list! Imagine, the best public schools/public education in the nation, one of the most educated populaces, a reasonably vibrant economy, health care for all, progressive social policies including one of the most strict gun control laws in the nation, and we haven't taxed the pants off our citizens (despite popular/uneducated opinion to the contrary).

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

- Sue U

- Posts: 9135

- Joined: Thu Apr 15, 2010 4:59 pm

- Location: Eastern Megalopolis, North America (Midtown)

Re: We're (NY) Number 1

Yes, but AL and AFC, that's not even civilized, come on!Guinevere wrote:I note that "Taxachusetts" is no where on that list! Imagine, the best public schools/public education in the nation, one of the most educated populaces, a reasonably vibrant economy, health care for all, progressive social policies including one of the most strict gun control laws in the nation, and we haven't taxed the pants off our citizens (despite popular/uneducated opinion to the contrary).

GAH!

Re: We're (NY) Number 1

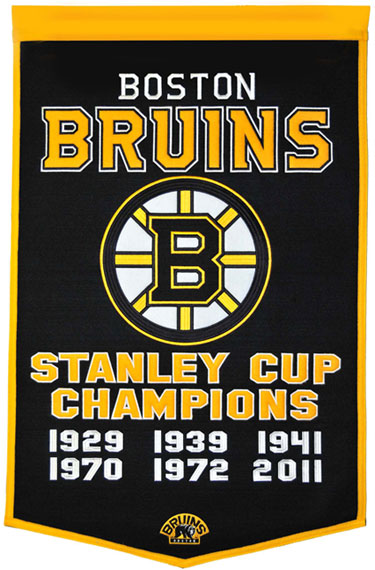

And the defending MLB World Champions are?????Sue U wrote:Yes, but AL and AFC, that's not even civilized, come on!Guinevere wrote:I note that "Taxachusetts" is no where on that list! Imagine, the best public schools/public education in the nation, one of the most educated populaces, a reasonably vibrant economy, health care for all, progressive social policies including one of the most strict gun control laws in the nation, and we haven't taxed the pants off our citizens (despite popular/uneducated opinion to the contrary).

Here's a hint:

As for the football piece, who did the Iggles lose to in their last Superbowl appearance? Here's another hint (Three rings, more than all the Iggles Championship wins over the last umpteen decades):

And hey, how 'bout those (expansion team) Flyers . . .

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

-

oldr_n_wsr

- Posts: 10838

- Joined: Sun Apr 18, 2010 1:59 am

Re: We're (NY) Number 1

Who did the Pats lose to in their last two SB apperances?

And they haven't won a SB since the infamous spygate SB (against the Rams IIRC).

Coincedence?

And they haven't won a SB since the infamous spygate SB (against the Rams IIRC).

Coincedence?

- Sue U

- Posts: 9135

- Joined: Thu Apr 15, 2010 4:59 pm

- Location: Eastern Megalopolis, North America (Midtown)

Re: We're (NY) Number 1

Oh, you must be feeling better!Guinevere wrote: [paraphrase] yadda yadda yadda [/paraphrase]

GAH!

Re: We're (NY) Number 1

Yes, MA has fallen out of the top ten. Basically: NY and NJ are like having stage 3 renal cancer, where MA is more like having a case of the clap.Guinevere wrote:I note that "Taxachusetts" is no where on that list! Imagine, the best public schools/public education in the nation, one of the most educated populaces, a reasonably vibrant economy, health care for all, progressive social policies including one of the most strict gun control laws in the nation, and we haven't taxed the pants off our citizens (despite popular/uneducated opinion to the contrary).

Treat Gaza like Carthage.

Re: We're (NY) Number 1

Hey Jarl, stop pissing on my state and get your own in order. Thx.

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: We're (NY) Number 1

YOU served up that big ole softball .....I was duty bound to reply.Sue U wrote:Oh, you must be feeling better!Guinevere wrote: [paraphrase] yadda yadda yadda [/paraphrase]

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: We're (NY) Number 1

Not mystate anymore & never will be again!Guinevere wrote:Hey Jarl, stop pissing on my state and get your own in order. Thx.

Treat Gaza like Carthage.

Re: We're (NY) Number 1

Did you move then?

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: We're (NY) Number 1

Boston has the longest wait-times to see a doctor in the nation. >2x as long as the national average. And did so before Romneycare:

http://www.washingtonpost.com/blogs/won ... 18-5-days/

yrs,

rubato

http://www.washingtonpost.com/blogs/won ... 18-5-days/

"... The longest waits were in Boston, where patients wait an average of 72 days to see a dermatologist and 66 days to see a family doctor. The shortest were in Dallas, where the average wait time is 10.2 days for all specialties, and just five days to see a family doctor. ...

Even Boston, which has eye-popping wait times, has gotten better. The city’s average wait time dropped from 50 days in 2009 to 45 days in 2013. That’s brings it closer to its level of 39 days in 2004 before Massachusetts adopted its version of health care reform. ... ""

yrs,

rubato

-

oldr_n_wsr

- Posts: 10838

- Joined: Sun Apr 18, 2010 1:59 am

Re: We're (NY) Number 1

Can some explain the difference between "a physician in family practice" and "a family physician"?

It seems they are the same thing, so why put them in both time categories?

Makes the ratings suspect.

It seems they are the same thing, so why put them in both time categories?

Makes the ratings suspect.

- MajGenl.Meade

- Posts: 21506

- Joined: Sun Apr 25, 2010 8:51 am

- Location: Groot Brakrivier

- Contact:

Re: We're (NY) Number 1

Wow! I sure hope they have lots of Reader's Digests in the waiting room.The longest waits were in Boston, where patients wait an average of . . . 66 days to see a family doctor

For Christianity, by identifying truth with faith, must teach-and, properly understood, does teach-that any interference with the truth is immoral. A Christian with faith has nothing to fear from the facts

Re: We're (NY) Number 1

MajGenl.Meade wrote:Wow! I sure hope they have lots of Reader's Digests in the waiting room.The longest waits were in Boston, where patients wait an average of . . . 66 days to see a family doctor

Decades worth.

yrs,

rubato

Re: We're (NY) Number 1

First of all, using dermatologists as the keystone is ridiculous because they are one of the smallest, most coveted specialties in medicine and its a notoriously understaffed field. I book my annual skin check with my derm at my last appointment -- so if you are organized, there is no problem. If you aren't, then you will wait, yes. If you have an emergency, they will fit you in. Mine isn't taking new patients because he is so busy.

When I'd had an immediate/urgent health need I've never had to wait more than a day to see my GP or someone in her practice (she only works half-time). Same with my eye doctor. I've never heard of anyone waiting anywhere near that long to see a physician, other than the derm, and never on any urgent basis.

When I'd had an immediate/urgent health need I've never had to wait more than a day to see my GP or someone in her practice (she only works half-time). Same with my eye doctor. I've never heard of anyone waiting anywhere near that long to see a physician, other than the derm, and never on any urgent basis.

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: We're (NY) Number 1

Where are you going?Jarlaxle wrote:March or April, its looking like.

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: We're (NY) Number 1

Dermatologists were not the keystone. See link. Click through for article.

Gynecology, Boston, 46 days (avg)

Family practice Boston, 66 days (avg)

Overall average, Boston, 46 days (avg)

yrs,

rubato

Gynecology, Boston, 46 days (avg)

Family practice Boston, 66 days (avg)

Overall average, Boston, 46 days (avg)

yrs,

rubato

Re: We're (NY) Number 1

Southern NH...Nashua, Amherst, or Merrimack...possibly Pelham or Salem.Guinevere wrote:Where are you going?Jarlaxle wrote:March or April, its looking like.

Treat Gaza like Carthage.