Shutdown

Re: Shutdown

The irony here, of course, is that Dems are effectively hijacking a Republican bill in an effort to undercut the whole House GOP strategy.

http://www.washingtonpost.com/blogs/plu ... overnment/

Dems move to force Republicans to reopen the government

By Greg Sargent, Published: October 4 at 1:45 pmE-mail the writer

House Democratic leaders believe they have hit on a new way to potentially force House Republican leaders into allowing a vote on a “clean CR” funding the government without any defunding of Obamacare attached.

At last count, as many as two dozen House Republicans appear prepared to vote for a clean CR. With Democrats included, that means a majority of the House of Representatives would vote right now to reopen the government. But the House GOP leadership won’t allow such a vote.

Dems have hit on a way to use a “discharge petition,” which forces a House vote if a majority of Representatives signs it, to try to force the issue. Previously, it was thought this could not work, because a discharge petition takes 30 legislative days to ripen, so if this were tried with the clean CR that passed the Senate, this couldn’t bear fruit until some time in November.

But now House Democrats say they have found a previously filed bill to use as a discharge petition — one that would fund the government at sequester levels.

The bill in question is the “Government Shutdown Prevention Act,” which was introduced in March by GOP Rep. James Lankford of Oklahoma. As the Congressman’s release describes it:

... (see link for article)

UPDATE: One slight clarification. If Dems can get the 218 signatures on the discharge petition, then Dems would use a procedural move to replace the Lankford bill with an amendment: A clean CR, just like the one in the Senate. So this would not enshrine the periodic one-percent reductions in spending in the Lankford measure.

Let's see 20/232, 8.6%, are there even this many people in the Republican caucus who care about the country? Who care about not causing suffering?

Guess we will find out! I love experiments, don't you?

yrs,

rubato

Re: Shutdown

This is exactly the kind of compromise that makes perfect sense, but it would require both sides to come off their high horses to get it done, so it probably doesn't have a chance:

But as you can see from that article, his own liberal party members don't want a six month extension because they're in a lather about the cuts to social programs in the sequester...(of course most of them are also on the record as opposing even the most modest forms of entitlement reform, so they live in their own fantasy world as much as the Tea Party types do; they believe that all problems can be solved simply by taxing "rich" people enough....)

Swapping out repeal of the medical device tax, (which is likely to happen anyway) in exchange for a six month as opposed to six week extension of the CR would be a huge win for the Obama Administration at this point, (the objection to tying it directly to the CR could be easily gotten around if Boehner and Reid could make a deal to present both the CR and the device tax repeal on the same day...both would pass...and also if Obama would agree to sign both.)

Bipartisan group calls for six-month funding bill with medical device tax repeal

A bipartisan group of House lawmakers say they’d support legislation to fund the government that repealed a medical device tax that's helping to fund President Obama's healthcare law.

The measure was put together by Reps. Ron Kind (D-Wis.) and Charlie Dent (Pa.), one of a handful of House Republicans who has called for moving a clean bill to fund the government.

Dent acknowledged that the proposal will be rejected by both conservatives who want much stronger provisions derailing ObamaCare, and liberals who oppose the sequester-level funding cap.

“But it's important that we accept incremental progress when we can. And this is one of those times,” said Dent, one of about a dozen House members who backed the proposal.

But Senate Majority Leader Harry Reid (D-Nev.) and House Minority Leader Nancy Pelosi (D-Calif.) quickly rejected the plan.

"We're willing to talk about that and anything else, but this proposal is an act of desperation on their standpoint. You can't do it. It involves tens of billions of dollars," Reid said.

Dent and Kind have circulated a letter to colleagues seeking support for their medical device tax repeal and calling to extend government funding for a full six months.

GOP leaders tried over the weekend to repeal the medical device tax as part of their continuing resolution (CR) package, but it was rejected by Democrats in both chambers for two central reasons:

First, the Democrats opposed the absence of an offset, which would have resulted in $30 billion in new deficit spending. And second, the Democrats say they're not willing to negotiate ObamaCare provisions as part of the current spending fight.

Still, 17 mostly centrist House Democrats voted with Republicans to repeal the device tax in a short-term spending bill over the weekend, though Kind voted against that proposal.

The Kind-Dent proposal attempts to address the Democrats' first issue, offsetting the cost with a "pension smoothing" provision tucked into last year’s Senate transportation bill that would adjust how much companies contribute to pensions.

But their approach does not address Democrats' concern about setting a precedent by considering unrelated provisions as a part of must-pass fiscal bills.

Indeed, Democratic leaders in both chambers were quick to shoot down the proposal, at least in part, because it would extend the sequester cuts for six months. House Democratic leaders also argued against Kind's proposal at a party meeting Thursday morning, according to several Democrats in the room.

“The 986 [level] for six months is devastating to our country,” Pelosi said Thursday afternoon during a press conference, referring to the sequester's $986 billion spending cap. “When I said we'll approve the number, it was for six weeks, not for six months.”

Dent said he and Rep. Jim Gerlach (R-Pa.) presented the plan to House Speaker John Boehner (R-Ohio) on Wednesday.

“They're not prepared to say he's going to endorse it. You'd have to talk to him,” Dent said. “But he's certainly aware of it.”

It is true that lawmakers from both parties are no fans of the medical device tax, with Democrats from states with large device industries — such as Minnesota, Massachusetts and Indiana — helping to lead the charge for repeal.

Senate Majority Whip Dick Durbin (D-Ill.) has also sounded open to repealing it, as long as the revenue to help pay for the healthcare law was replaced. Sen. Orrin Hatch (Utah), the top Republican on the tax-writing Finance Committee, called the tax a “stupid dumb-ass thing” in the run-up to the current shutdown.

The full Senate expressed support for repeal, 79-20, in a nonbinding budget resolution vote this year.

But Reid and Finance Committee Chairman Max Baucus (D-Mont.) were among those voting against repeal. Supporters of the medical device tax say that the industry will be helped after ObamaCare increases insurance rolls by millions of people.

Read more: http://thehill.com/blogs/healthwatch/he ... z2gs78k4Ku

Follow us: @thehill on Twitter | TheHill on Facebook

But as you can see from that article, his own liberal party members don't want a six month extension because they're in a lather about the cuts to social programs in the sequester...(of course most of them are also on the record as opposing even the most modest forms of entitlement reform, so they live in their own fantasy world as much as the Tea Party types do; they believe that all problems can be solved simply by taxing "rich" people enough....)

Re: Shutdown

Repealing the medical device tax, a 2.3% tax on medical devices is a compromise to ... to ... whom? It is stupid. Merely a sop to a few very rich Republican donors who make billions from selling medical devices paid for by ... Medicare and Medicaid. :

http://www.offthechartsblog.org/scare-t ... h-reality/

yrs,

rubato

http://www.offthechartsblog.org/scare-t ... h-reality/

Although the Senate rebuffed the House’s attempt to attach a repeal of health reform’s excise tax on certain medical devices to the fiscal year 2014 funding bill, the issue will likely resurface. We recently updated our paper explaining why the 2.3 percent tax, which helps pay for extending health coverage to millions of uninsured Americans, is sound and why the arguments against it do not withstand scrutiny. Here are some key facts to keep in mind.

The medical device tax isn’t a tax on wheelchairs, as some commentators have mistakenly reported. The tax does not apply to eyeglasses, contact lenses, hearing aids, mechanical and powered wheelchairs, and any other medical device that the public generally buys at retail for individual use. It does apply to such devices as coronary stents, artificial knees and hips, cardiac pacemakers, irradiation equipment, and imaging technology.

Health reform will boost sales of medical devices, largely offsetting the effect of the tax. By extending health coverage to 25 million more Americans, health reform will raise demand for medical devices and boost the revenue of device manufacturers. The medical device industry correctly notes that older patients, who use a disproportionate number of medical devices, already have coverage through Medicare. However, some of the previously uninsured people who get health coverage under health reform will undergo elective medical procedures, which in turn will expand the use of medical devices. A study by Wells Fargo Securities finds that health reform will increase device sales by 1.5 percent in 2014 and by 3.6 percent cumulatively through 2022. This increase, the study concludes, “will be sufficient to offset” the tax.

Top device manufacturers are highly profitable and can easily absorb the tax. A new report by Consumers Union examines the financial statements of 18 leading device companies and finds that they are all well situated to absorb the tax without a significant effect on their bottom line. Investors apparently agree. Since the tax took effect in January 2013, the stock prices of the top device manufacturers have generally outperformed the market averages. For example, Medtronic is up 29 percent, Johnson and Johnson 24 percent, Boston Scientific 104 percent, and St. Jude Medical 46 percent — compared to a 19 percent increase in the S&P 500 stock index.

Clearly, the medical device tax is not having the dire effects that its critics predicted.

yrs,

rubato

- Econoline

- Posts: 9607

- Joined: Sun Apr 18, 2010 6:25 pm

- Location: DeKalb, Illinois...out amidst the corn, soybeans, and Republicans

Re: Shutdown

I could be wrong, but I thought that the real problem with a repeal of the medical device tax was that Congress would have to agree on either a tax increase somewhere else to replace it or budget cuts somewhere else to offset it--which would open up a whole 'nother can-o-worms.

People who are wrong are just as sure they're right as people who are right. The only difference is, they're wrong.

— God @The Tweet of God

— God @The Tweet of God

- Econoline

- Posts: 9607

- Joined: Sun Apr 18, 2010 6:25 pm

- Location: DeKalb, Illinois...out amidst the corn, soybeans, and Republicans

Re: Shutdown

BTW, Jim, I'd be interested in your take on this other thread I started. I thought it was a pretty good commentary, not too judgemental (even though it was written by an Australian  ), which raised some real issues that the Republican party will have to face.

), which raised some real issues that the Republican party will have to face.

People who are wrong are just as sure they're right as people who are right. The only difference is, they're wrong.

— God @The Tweet of God

— God @The Tweet of God

- Econoline

- Posts: 9607

- Joined: Sun Apr 18, 2010 6:25 pm

- Location: DeKalb, Illinois...out amidst the corn, soybeans, and Republicans

Re: Shutdown

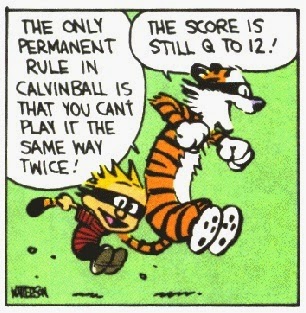

This would make cricket a lot more interesting, and a lot more fun:Lord Jim wrote:That looks a lot like cricket....

People who are wrong are just as sure they're right as people who are right. The only difference is, they're wrong.

— God @The Tweet of God

— God @The Tweet of God

Re: Shutdown

I'm only going to explain this to you once, because you are so profoundly and deeply stupid, you make my eyebrows ache...(Explaining it to you a second time would make me want to jump off the nearest bridge...)Repealing the medical device tax, a 2.3% tax on medical devices is a compromise to ... to ... whom? It is stupid. Merely a sop to a few very rich Republican donors who make billions from selling medical devices paid for by ... Medicare and Medicaid. :

Anybody remember the Jimmy Carter "luxury tax"?...

All that accomplished was to put the US ship building and private airplane business out of business...

Hardworking Americans, making decent incomes, thrown under the bus...

Rubato is an excellent example of why I will never ever become a Democrat...

As disappointed and embarrassed as I am with the behavior of many within my party, I'll still take them any day over a "rubato"....

(Given the fact that I see many of these folks as Randian whack jobs, that ought to tell you what I think of rube...)

Re: Shutdown

That's really an interesting philosophical question...

What if on the one hand, you had a bunch of Randian troglodytes, who were hell bent for repealing the Social Contract...

But on the other hand, you had an ignorant moron like rube, who can't do simple sums and couldn't find his own ass with both hands and a GPS....

And you had to choose between the judgement offered by both of them...

A choice like that makes it easy to understand the popularity of suicide...

What if on the one hand, you had a bunch of Randian troglodytes, who were hell bent for repealing the Social Contract...

But on the other hand, you had an ignorant moron like rube, who can't do simple sums and couldn't find his own ass with both hands and a GPS....

And you had to choose between the judgement offered by both of them...

A choice like that makes it easy to understand the popularity of suicide...

Re: Shutdown

Jim--when the luxury tax was enacted, some stopped buying airplanes and luxury yachts; but do you really think people will stop having bypass surgery, hip replacements, or MRIs to avoid the tax? I just don't see it.

Re: Shutdown

Yes people will still get those things, (so rubato's billionaires will still make their money) they just won't be manufactured here, so those jobs will be lost.do you really think people will stop having bypass surgery, hip replacements, or MRIs to avoid the tax? I just don't see it.

Re: Shutdown

OK, rather than looking the law up, does it actually say only devices manufactured in the us are subject to the tax?

Re: Shutdown

No, the regulations impose the tax liability on the manufacturer, producer, or importer of the devices.Big RR wrote:OK, rather than looking the law up, does it actually say only devices manufactured in the us are subject to the tax?

The final regulation, comments, etc, here:

https://s3.amazonaws.com/public-inspect ... -29628.pdf

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: Shutdown

That's what I thought. So Jim, unless people leave the US to have the surgeries, why would imported devices be preferred (on account of the tax)?

Re: Shutdown

My understanding of the opposition to the medical device tax is that the producers believe they will be squeezed by the hospitals and other purchasers -- that is, they will have to pay the tax but will not be able to pass the cost onto the purchaser. Plus, there is the basic economic premise that if you make a product more expensive, there will be fewer purchases and less incentive to innovate. I don't know if a 2.3% swing will have a great impact, but it may on the edges. And vis a vis a foreign manufacturer, if the foreign company gets most of its revenue from sales outside the U.S., the 2.3% tax will have less of an impact than for U.S. companies that get most of their revenue from sales in the U.S.

Whereas, insurance companies were willing to go along with a lot of the ACA mandates because they knew they would be getting a lot of new, healthy young customers, the medical device people do not see those newly insured persons as adding to their market which is comprised mainly of middle-aged and older who already have health coverage.

From my standpoint, the medical device tax is just another bad tax policy in the ACA because it taxes a few to pay benefits that go to everyone. This is a common problem with the ACA; there are a bunch of taxes that hit one group or another to pay for coverage for people who cannot get or choose not to have health coverage. This is rightfully a general tax burden, but they D's knew they could not impose a general tax for this so instead came up with this mishmash of new taxes. As a result, the ACA taxes the people who are already doing the right thing by providing health coverage or getting health coverage to pay for those who have been doing the wrong thing by not having coverage. It is further bad tax policy because the more little taxes there are, the more complicated the compliance, the more dollars spent trying to comply with the law and to enforce the law.

Whereas, insurance companies were willing to go along with a lot of the ACA mandates because they knew they would be getting a lot of new, healthy young customers, the medical device people do not see those newly insured persons as adding to their market which is comprised mainly of middle-aged and older who already have health coverage.

From my standpoint, the medical device tax is just another bad tax policy in the ACA because it taxes a few to pay benefits that go to everyone. This is a common problem with the ACA; there are a bunch of taxes that hit one group or another to pay for coverage for people who cannot get or choose not to have health coverage. This is rightfully a general tax burden, but they D's knew they could not impose a general tax for this so instead came up with this mishmash of new taxes. As a result, the ACA taxes the people who are already doing the right thing by providing health coverage or getting health coverage to pay for those who have been doing the wrong thing by not having coverage. It is further bad tax policy because the more little taxes there are, the more complicated the compliance, the more dollars spent trying to comply with the law and to enforce the law.

Re: Shutdown

Long Run, the answer to your concerns is simple: single payor. Health care for all. You know, what most civilized nations provide for their citizens.

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

- Sue U

- Posts: 9143

- Joined: Thu Apr 15, 2010 4:59 pm

- Location: Eastern Megalopolis, North America (Midtown)

Re: Shutdown

Commie.Guinevere wrote:Long Run, the answer to your concerns is simple: single payor. Health care for all. You know, what most civilized nations provide for their citizens.

GAH!

Re: Shutdown

Speak for yourself!Sue U wrote:Commie.Guinevere wrote:Long Run, the answer to your concerns is simple: single payor. Health care for all. You know, what most civilized nations provide for their citizens.

“I ask no favor for my sex. All I ask of our brethren is that they take their feet off our necks.” ~ Ruth Bader Ginsburg, paraphrasing Sarah Moore Grimké

Re: Shutdown

LR--we aren't talking about a luxury here, we're talking about saving someone's life; I doubt a 2.3% swing would make a difference and have someone say "I'd rather die than pay that".

As for the foreign companies, most of them come from countries with single payor systems where the costs and profits are highly controlled. For pharmaceuticals and medical devices, the big payoff comes from the US which does not exercise such controls over the providers. That's why everyone wants to sell in the US.

As for

As for the foreign companies, most of them come from countries with single payor systems where the costs and profits are highly controlled. For pharmaceuticals and medical devices, the big payoff comes from the US which does not exercise such controls over the providers. That's why everyone wants to sell in the US.

As for

, let's not forget many diagnostic devices, like those in imaging, are also included. Sure, younger people won't, by and large, be getting coronary artery stents, but broader coverage will mean more people getting MRIs and other diagnostic procedures.Whereas, insurance companies were willing to go along with a lot of the ACA mandates because they knew they would be getting a lot of new, healthy young customers, the medical device people do not see those newly insured persons as adding to their market which is comprised mainly of middle-aged and older who already have health coverage.